Women & Cannabis

Insights on This Rapidly-Growing Segment of the Cannabis Industry

The traditionally male-centric cannabis industry is rapidly shifting. While male consumers continue to dominate the market, female cannabis consumers have become the one of the fastest-growing segments of the industry.

As a marketing and data intelligence agency, we continually provide deep insights into consumer trends for various clients, including entertainment, consumer products, brand groups, and the emerging cannabis industry. Our Actionable Intelligence™ team studied 480,112 female cannabis consumers to produce a comprehensive analysis of consumption methods, demographics, and social media activity.

So, let’s take a deeper look at what the data shows about the women of cannabis.

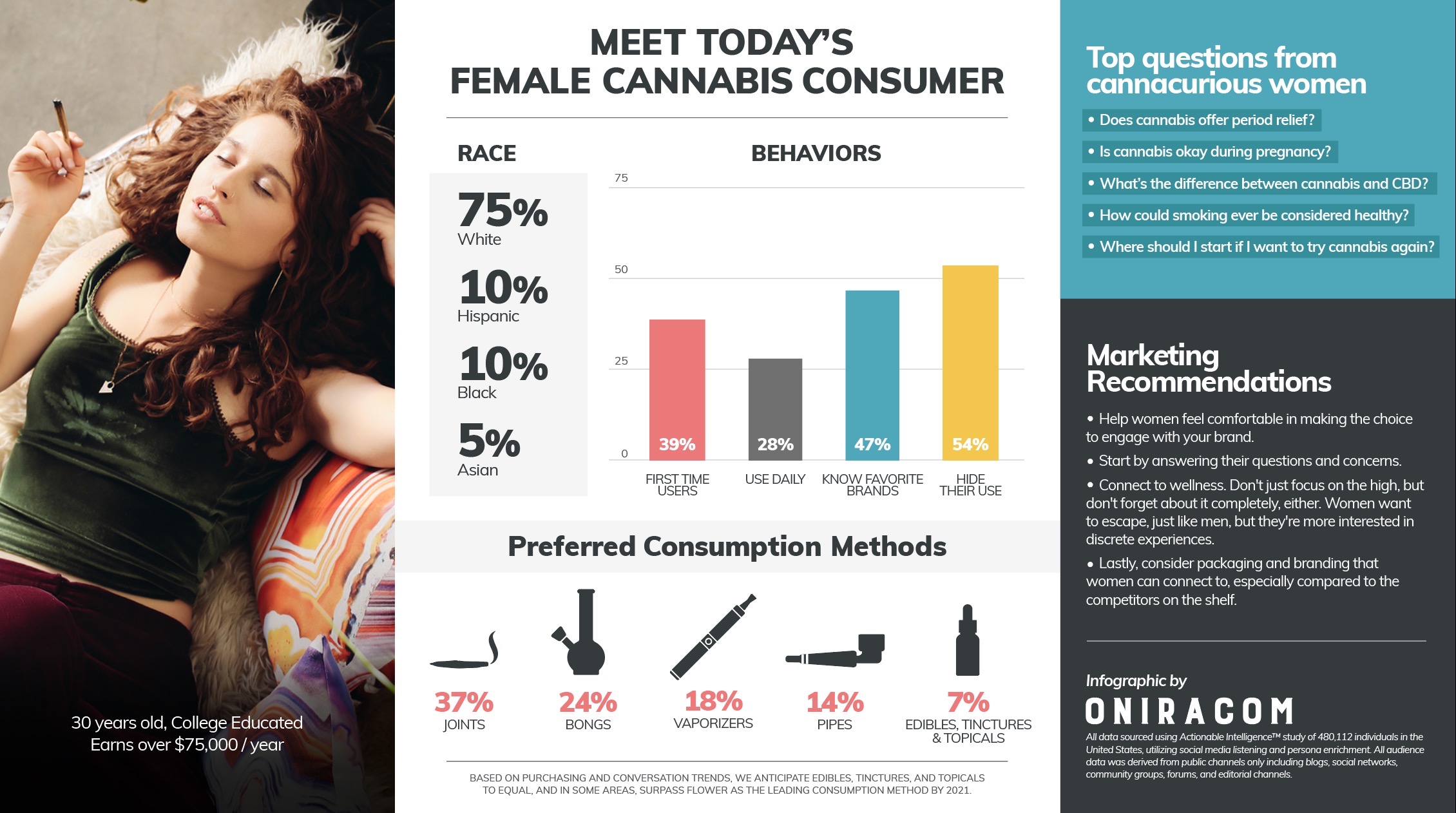

The average female cannabis consumer is 29.9 years old and works full time (84% of female users). Additionally, the majority of female users are white (60+%), college-educated (68%), have household incomes of at least $75K (65%), and living with a partner or married (63%). Pain alleviation and stress relief tend to be the motivating factors behind many women’s cannabis use. Women have begun recognizing the medicinal purposes of cannabis and implemented it within their wellness regimens.

The legalization of cannabis in certain states has reshaped the image of cannabis and prompted the growth of robust marketplaces in particular geographic areas. California’s cannabis sales represent approximately 34% of legal sales within the United States while the combined sales in Washington, Oregon, and Colorado constitute 41%. New legislation reforms have caused consumer preferences and retail trends to evolve and consequently has generated interest in cannabis use across various demographic groups.

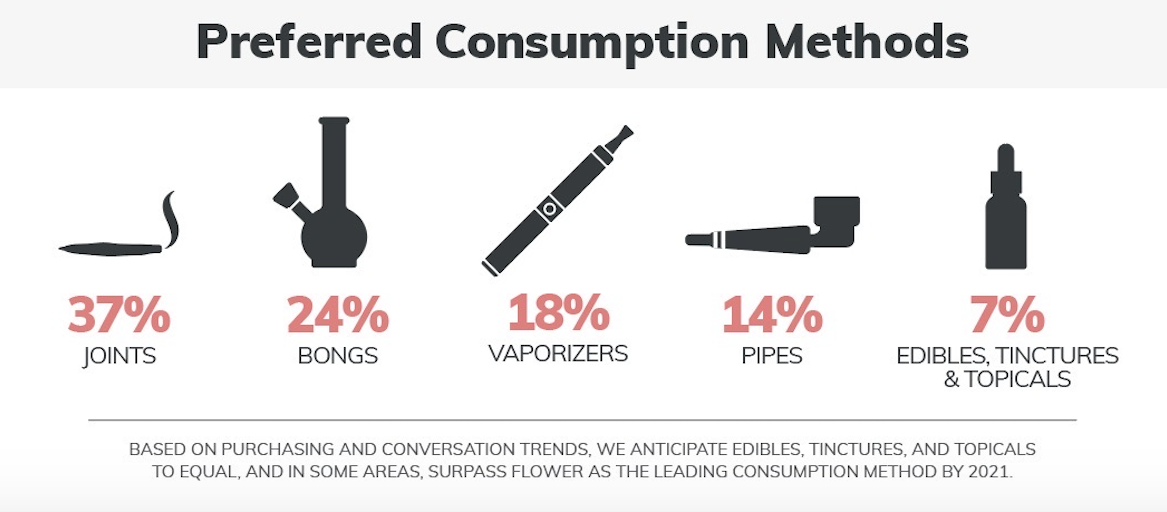

As the demographics of cannabis users shift, methods of ingestion are also changing. Flower use decreased from 55% in 2015 to 40% at the end of 2018. Currently, 37% of women smokers use joints as their main mode of ingestion. Bongs come in as a popular second. 18% of female cannabis users to prefer vaping over any other method. Although only 7% of women currently identify edibles as their preferred method of cannabis consumption, edibles are the most rapidly expanding category in the Industry. Legal cannabis sales from 2015-2018 showed that edible sales progressed from 16% to 39%. The appeal stems from the large variety of edibles and luxurious cannabis-infused topicals. We expect to see the use of edibles increase dramatically among women in 2020 and beyond.

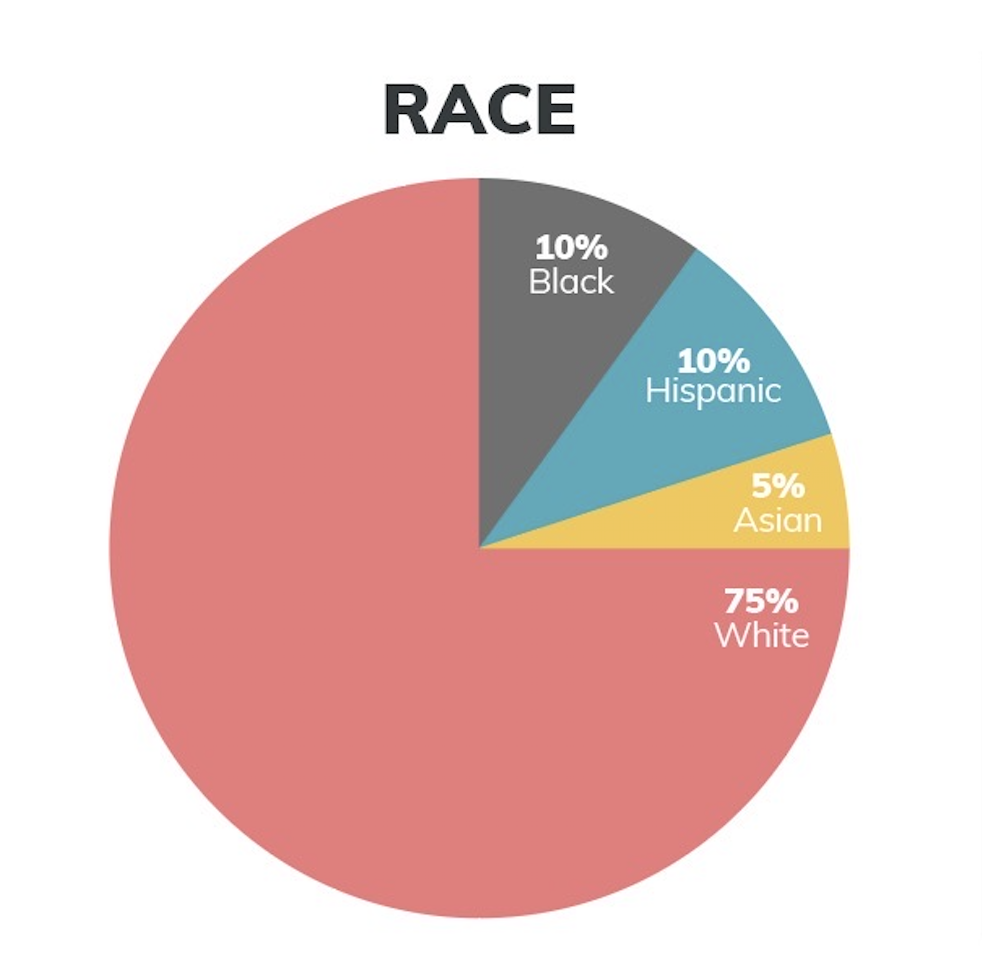

White women encompass the majority of the female market (75%) followed by Hispanic (10%) and Black (10%) users. Particular segments of the market such as young mothers (ages 21-30) and working women (ages 31-40) have a more developed interest in cannabis products.

Female engagement in cannabis doesn’t stop at product consumption; women have begun entering the cannabis business in full force and control 36% of the industry’s leadership positions today.

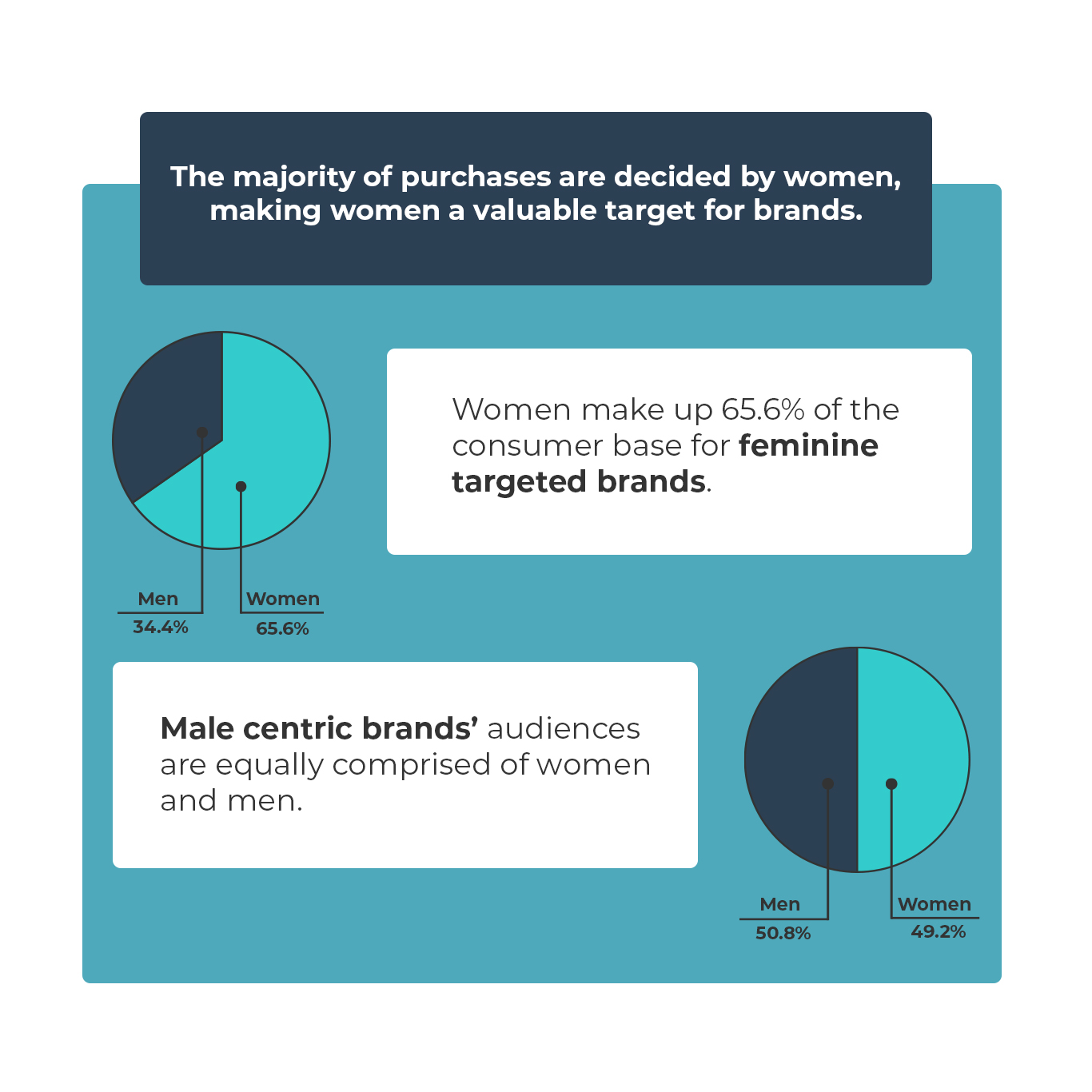

This growing segment of cannabis consumers offers a significant opportunity for emerging cannabis brands. The female cannabis consumer market is remarkably underserved with male-centric brands currently dominating shelf space. Brands should not underestimate the power of the female consumer – especially considering women make the majority of purchase decisions.

In order to attract female cannabis connoisseurs, companies must pay close attention to their branding in order to gain an advantage over their competitors in the market. The prestige of luxury brands entices female consumers into long term engagement and brand loyalty. Brands like Pressed Juicery, Everlane, and SoulCycle have built strong business presences by focusing on luxurious services and product lines that extend into their atmosphere, marketing, and imagery.

Our research has identified luxury is the most effective with consumers ages 31 to 35 who make between $50K and $75K per year. This demographic accounts for the largest percentage of luxury brand consumers (22.8%), closely followed by households that earn $125K or more (21.5%). Although both men and women demonstrate an affinity for luxury brands, 55.5% of the market is made up of women. Thus, emerging luxury cannabis brands should cater to the diverse interests of women but be careful not to exclude male consumers.

While much of the cannabis industry has historically neglected marketing to females, there are a few early moving brands disrupting the market. Whoppi & Maya, Canndescent, Lord Jones, Beboe, Embra Cannabis, and Annabis & AuBox are among the first companies marketing luxury cannabis products today. Luxury branding and greater accessibility are changing consumer sentiment on cannabis, opening a window of opportunity for industry growth. Many cannabis companies have encouraged users to implement cannabis in their personal care routine in order to rebrand the plant as a luxurious lifestyle product.

As the prominence of women in the cannabis world continues to grow, the industry must shed its outdated view of female users as a niche market and recognize the presence of women in the business. Women are making powerful contributions to the cannabis industry and rightfully demand high-quality products. It’s critical for brands to be aware of shifts in their consumer base, and smart brands will respond with effective decisions about their products and marketing.

For more information about how Oniracom’s Actionable Intelligence™ can inform and direct your strategic planning, creative production, and engagement marketing, visit our capabilities page.